Managing payroll and compliance has become one of the most demanding responsibilities for HR teams. As businesses grow, so do employee records, salary structures, tax obligations, and legal requirements. Even a small mistake in payroll calculation or a missed compliance deadline can lead to financial penalties, employee dissatisfaction, and legal trouble.

HR software plays a crucial role in simplifying these challenges by automating repetitive tasks, organizing employee data, and supporting compliance with labor and tax regulations. When implemented correctly, it allows HR teams to focus more on people management and less on administrative complexity. This blog explains the most important HR software features that help streamline payroll and compliance in a structured and practical way.

What Is HR Software?

HR software is a digital system designed to manage and automate core human resource functions within an organization. It acts as a centralized platform where employee information, payroll data, attendance records, and compliance-related documents are stored and managed.

Key characteristics of HR software

- It centralizes employee data in one secure system

- It automates repetitive HR tasks such as payroll processing

- It supports compliance with labor laws and tax regulations

- It improves accuracy and reduces manual errors

HR software vs basic payroll tools

- Basic payroll tools focus only on salary calculations and payslip generation

- HR software includes payroll along with attendance, compliance, reporting, and employee management

- HR software provides a broader view of workforce data, which supports better decision-making

Why Payroll and Compliance Are Major HR Challenges

Payroll and compliance are closely connected and equally complex. Managing them manually increases the risk of errors, delays, and inconsistencies.

Key challenges faced by HR teams

- Payroll calculations become complicated with different salary structures, allowances, and deductions

- Tax rules and labor laws change frequently and vary by region

- Manual tracking increases the risk of missed deadlines and incorrect filings

- Non-compliance can lead to fines, audits, and damage to employer credibility

Business impact of payroll and compliance errors

- Employees lose trust when salaries are delayed or incorrect

- Financial penalties affect business profitability

- HR teams spend excessive time correcting avoidable mistakes

How HR Software Helps Streamline Payroll and Compliance

HR software reduces complexity by automating processes and maintaining consistency across payroll and compliance tasks.

How automation improves efficiency

- Eliminates repetitive manual calculations

- Reduces dependency on spreadsheets and paper records

- Ensures payroll processes follow predefined rules

Centralized data management

- Employee details, salary information, and compliance records are stored in one system

- Reduces duplication of data across multiple tools

- Improves accuracy and accessibility of information

Real-time compliance support

- Keeps HR teams informed about compliance requirements

- Helps maintain records that are ready for audits

Top HR Software Features to Streamline Payroll

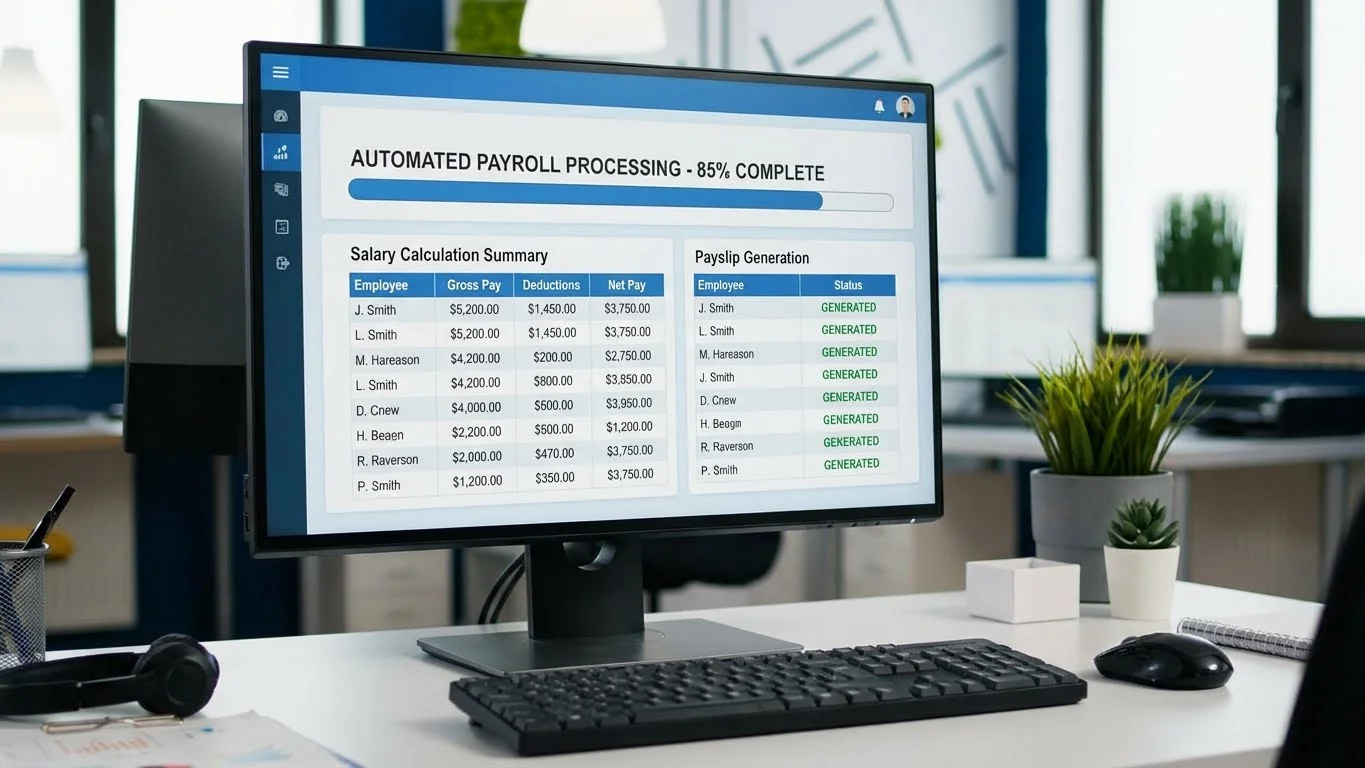

1. Automated Payroll Processing

Automated payroll processing is one of the most essential features of HR software. It ensures salaries are calculated accurately and consistently.

- Automatic calculation of monthly salaries

- Handling of bonuses, incentives, and reimbursements

- Standardized payslip generation

- Reduced risk of manual calculation errors

2. Tax Calculation and Filing Automation

Tax management is a major component of payroll accuracy and compliance. HR software simplifies this process by applying predefined tax rules.

- Automatic deduction of applicable taxes

- Support for region-specific tax structures

- Accurate tax reporting for employees and authorities

- Reduced dependency on manual tax calculations

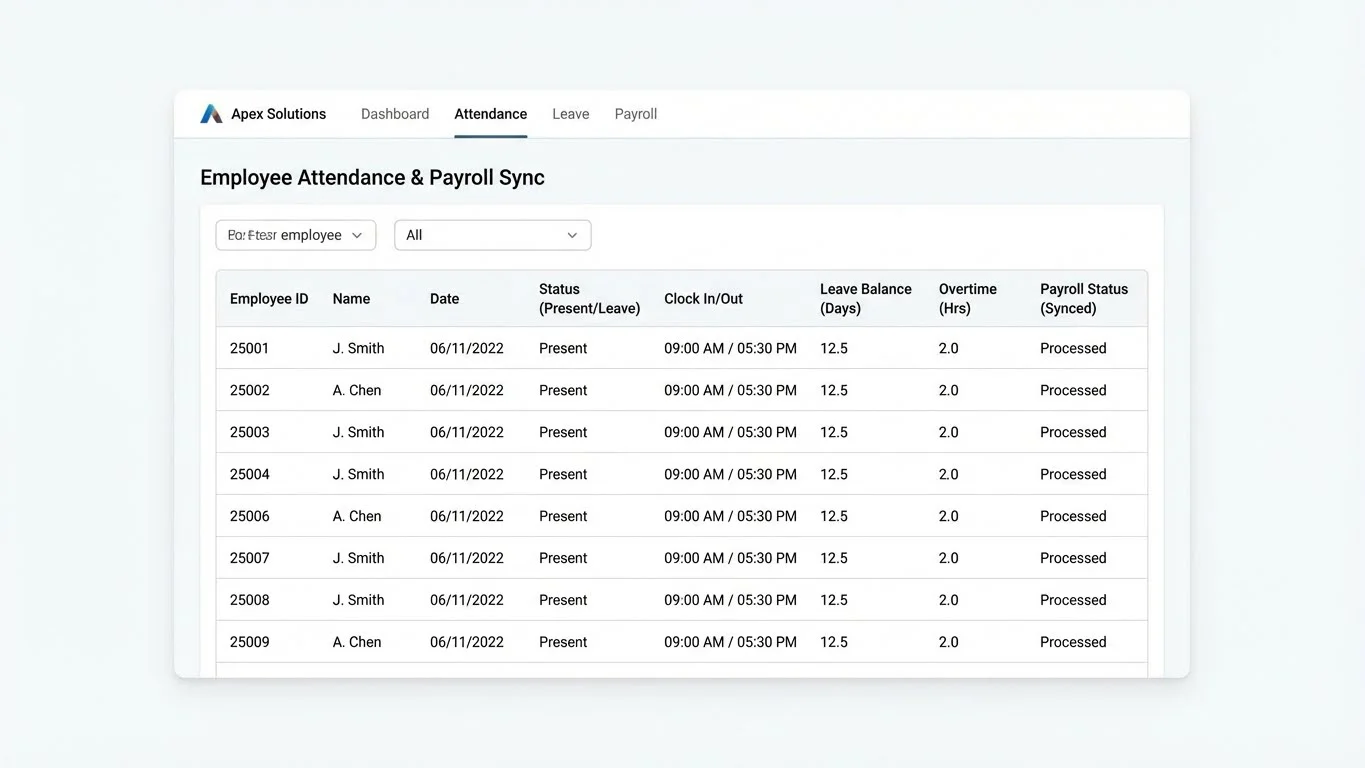

3. Attendance and Leave Integration

Payroll accuracy depends heavily on attendance and leave data. HR software integrates these systems to avoid discrepancies.

- Direct linkage between attendance records and payroll

- Automatic adjustment of salaries based on leaves and absences

- Accurate overtime and shift-based salary calculations

- Reduced conflicts related to attendance-based pay

4. Multi-Payment and Bank Integration

Modern businesses often use different salary structures and payment cycles. HR software supports flexible payroll execution.

- Direct salary transfers to employee bank accounts

- Support for multiple pay cycles such as monthly or bi-weekly

- Management of different compensation structures

- Reduced manual intervention in payment processing

Essential HR Software Features for Compliance Management

1. Statutory Compliance Management

Statutory compliance ensures that the organization follows labor laws and employment regulations.

- Tracking of minimum wage requirements

- Compliance with overtime and working-hour regulations

- Management of statutory benefits and deductions

- Maintenance of legally required employment records

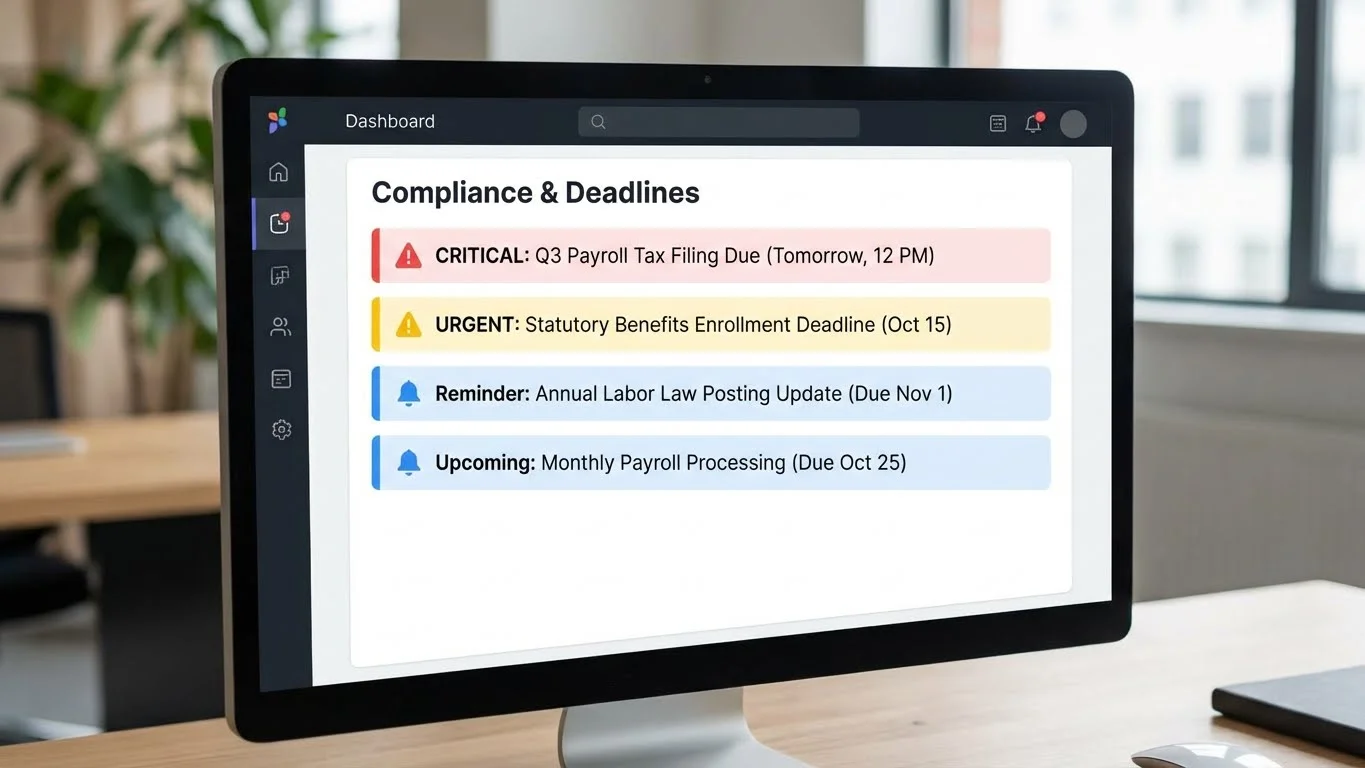

2. Compliance Alerts and Notifications

Missing compliance deadlines can result in penalties. HR software provides automated reminders to reduce this risk.

- Alerts for upcoming filing deadlines

- Notifications for changes in regulations

- Reminders for document renewals and submissions

- Reduced reliance on manual tracking systems

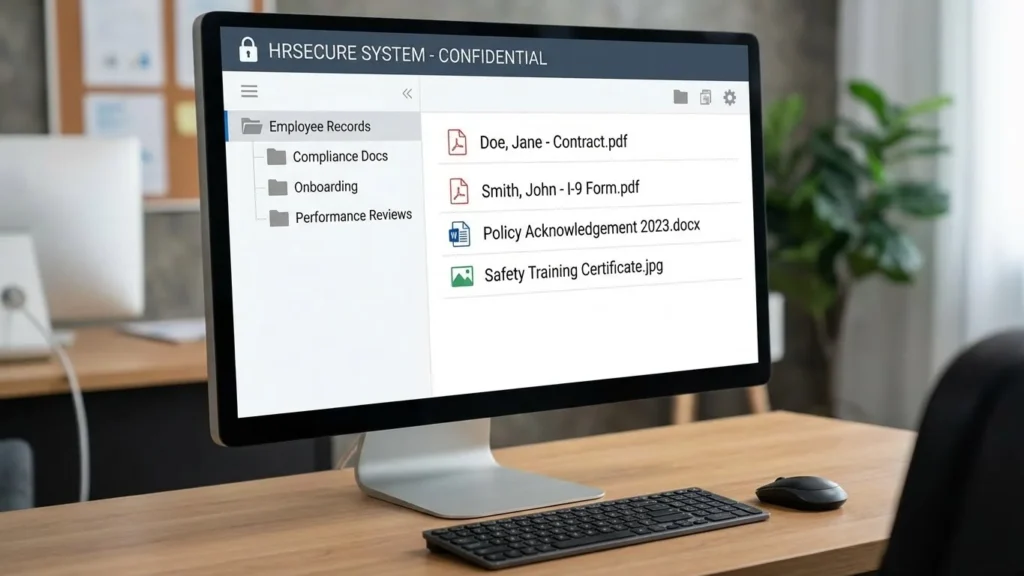

3. Document Management and Audit Readiness

Proper documentation is essential for compliance and audits. HR software organizes and secures important records.

- Centralized storage of employee contracts and compliance documents

- Easy retrieval during audits or inspections

- Digital records reduce dependency on physical files

- Improved transparency and accountability

4. Data Security and Access Control

Payroll and compliance data is sensitive and must be protected.

- Role-based access to payroll and employee data

- Restricted access to confidential information

- Secure handling of employee records

- Support for data protection and privacy standards

Advanced HR Software Features That Add More Value

1. Employee Self-Service Portal

Self-service portals reduce HR workload while improving employee experience.

- Employees can access payslips and tax documents

- Leave applications and approvals become faster

- Reduced dependency on HR for routine queries

- Improved transparency in payroll information

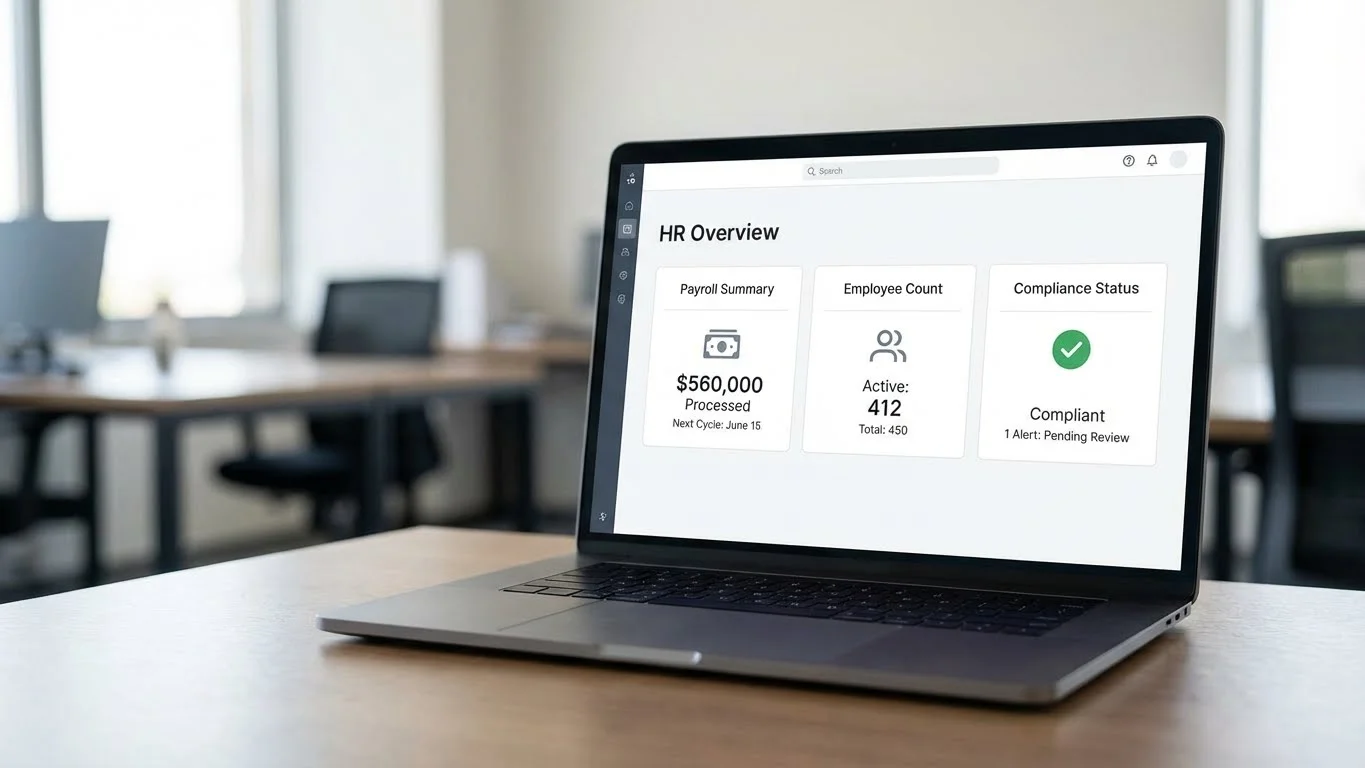

2. Real-Time Reports and Analytics

Data-driven insights help HR teams make informed decisions.

- Payroll cost summaries

- Compliance status reports

- Attendance and leave trends

- Better visibility into workforce-related expenses

3. Integration With Accounting and ERP Systems

Integration ensures smooth data flow between departments.

- Payroll data syncs with accounting systems

- Reduced data duplication and manual entry

- Improved accuracy in financial reporting

- Better coordination between HR and finance teams

How to Choose the Right HR Software for Payroll and Compliance

Selecting the right HR software requires careful evaluation of business needs.

Key factors to consider

- Size of the organization and workforce complexity

- Industry-specific compliance requirements

- Ease of use for HR teams and employees

- Scalability to support future growth

- Availability of support and regular updates

Benefits of Using HR Software for Payroll and Compliance

HR software provides measurable benefits across the organization.

- Reduced payroll processing time

- Lower risk of compliance violations

- Improved payroll accuracy

- Enhanced employee trust and satisfaction

- Better control over HR operations

Common Mistakes to Avoid When Selecting HR Software

Choosing the wrong HR software can create long-term challenges.

Mistakes businesses often make

- Ignoring compliance features during selection

- Choosing software that cannot scale with growth

- Overlooking data security measures

- Focusing only on cost instead of functionality

Conclusion

HR software has become an essential tool for organizations aiming to manage payroll and compliance efficiently. By automating payroll calculations, integrating attendance data, managing statutory requirements, and securing employee information, HR software reduces errors and operational risk.

Investing in the right HR software allows businesses to stay compliant, improve payroll accuracy, and create a better experience for employees and HR teams alike. When payroll and compliance processes are streamlined, organizations can focus more on growth, workforce development, and long-term stability.