Summary

The frequency of non-executive director meetings plays a crucial role in determining how effectively a company is governed and how strategically it performs. Non-executive directors (NEDs) act as independent overseers of corporate activities, ensuring that executives remain accountable and that strategic decisions align with the company’s long-term goals. Understanding how often these meetings occur, what they cover, and why their structure matters provides valuable insight into corporate governance. This blog explores the ideal meeting frequency, the importance of quality debate, the role of the chairman, and the time commitment expected of non-executive directors.

What is Non-Executive Directors and Their Purpose

Non-executive directors are appointed to a company’s board to provide independent judgment, objective oversight, and strategic advice. They are not involved in the day-to-day management of the organization but play a vital role in guiding direction, assessing performance, and ensuring good governance.

Their duties include reviewing company strategy, monitoring risk management frameworks, evaluating financial performance, and ensuring compliance with laws and ethical standards. Because of this, meetings involving non-executive directors are essential—they are the primary setting in which these duties are fulfilled. The question of how often do board of directors meet therefore becomes one of strategic importance rather than mere scheduling.

How Often Do Board of Directors Meet?

The frequency of board meetings, including those attended by non-executive directors, varies by company size, structure, and regulatory environment. In most organizations, boards meet regularly throughout the year to discuss performance, approve budgets, review risks, and assess long-term goals.

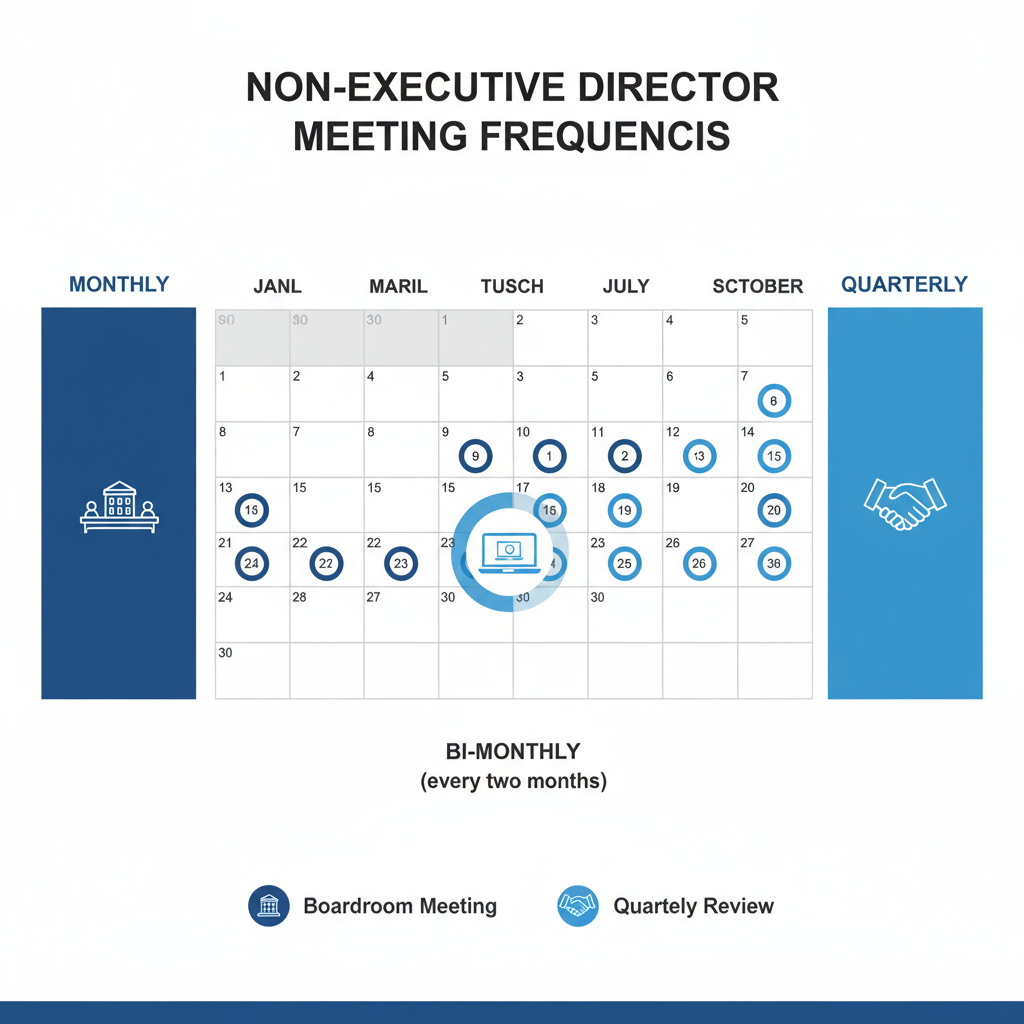

For many public and private companies, meetings are scheduled either monthly, bi-monthly, or quarterly. Larger corporations with complex operations often require more frequent meetings, while smaller organizations may meet fewer times each year but conduct in-depth reviews when they do.

A typical schedule may include:

- Regular meetings covering ongoing governance and financial issues.

- Special meetings called to address urgent matters or key strategic decisions.

- Annual general meetings where directors, including NEDs, assess company performance and strategic outlook.

Modern boards are increasingly adopting hybrid or virtual meeting formats to accommodate geographically diverse members and to increase flexibility. Virtual meetings also make it easier for directors to engage more frequently without the logistical challenges of travel.

What matters most, however, is not the number of meetings, but their quality and structure. Effective boards ensure that each meeting has a clear agenda, strategic focus, and time for meaningful debate.

Setting the Annual Board Calendar

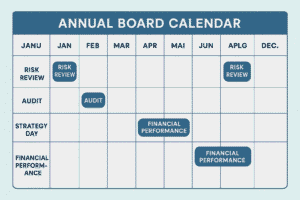

A well-structured board typically agrees on an annual schedule that outlines the key issues to be discussed throughout the year. This approach ensures that strategic and governance responsibilities are addressed consistently.

The chairman and CEO usually collaborate to create this program, identifying recurring topics such as risk reviews, audit updates, and performance evaluations. Non-executive directors play an active role in shaping this agenda, ensuring that external perspectives are considered and that discussions align with long-term objectives.

Having a predictable calendar also allows directors to plan their availability, review board materials in advance, and prepare more thoroughly for discussions. This practice enhances the depth of board deliberations and supports better decision-making.

The Importance of Strategy Discussions

One of the most significant responsibilities of non-executive directors is to contribute to the company’s strategic direction. Historically, non-executive directors were often presented with strategies that had already been finalized by the executive team. However, today’s boards expect NEDs to play an active role in shaping strategy from the start.

Strategy discussions help the board evaluate opportunities, assess competitive positions, and consider risks associated with new ventures or investments. These discussions are not just about approving plans—they involve questioning assumptions, exploring alternatives, and ensuring that decisions align with stakeholder interests.

Best practice suggests that every board should dedicate at least one major session each year, often called a strategy day, to focus exclusively on long-term planning. During such meetings, the board may discuss market trends, new technologies, and shifting customer expectations.

An effective strategy discussion agenda typically includes:

- Reviewing the company’s current strategy and performance outcomes.

- Conducting market and competitor analysis to identify growth opportunities.

- Evaluating strategic initiatives such as mergers, acquisitions, or diversification.

- Assessing potential risks and mitigation plans.

- Establishing key performance indicators and monitoring progress.

Such comprehensive discussions ensure that non-executive directors remain informed and engaged in shaping the organization’s future direction.

Quality of Debate in Non-Executive Director Meetings

The effectiveness of any board depends not only on how often it meets but also on the quality of its discussions. Meaningful debate encourages directors to challenge assumptions, exchange ideas, and bring forward independent perspectives.

A healthy board culture promotes open dialogue, where all members—executive and non-executive alike—feel empowered to voice opinions. This requires mutual trust, active listening, and a willingness to explore differing viewpoints. The chairman plays a central role in facilitating this environment, ensuring that discussions remain focused yet inclusive.

To foster quality debate, meeting materials should be concise, clear, and distributed well in advance. Board packs often contain hundreds of pages of reports, financial data, and strategic plans. Providing these documents early allows directors to digest complex information, identify key issues, and prepare thoughtful questions.

Structured yet flexible debates help boards make informed decisions. Instead of spending excessive time on executive presentations, more emphasis should be placed on discussion and analysis. The chairman should summarize the key outcomes and ensure that differing perspectives are recorded for future reference.

Quality debate offers numerous benefits:

- Encourages diverse perspectives that enhance creativity and innovation.

- Strengthens the decision-making process.

- Builds trust among board members.

- Improves oversight and governance outcomes.

- Ensures that risks and opportunities are fully explored before decisions are made.

Role of the Chairman in Effective Board Meetings

The chairman is instrumental in ensuring that board meetings are productive. Their responsibilities extend beyond chairing discussions—they must cultivate an environment where directors feel valued, engaged, and focused on governance priorities.

An effective chairman ensures that all directors, especially non-executives, have equal opportunities to contribute. They balance executive insights with independent viewpoints and prevent any single voice from dominating the discussion. The chairman also mediates conflicts, keeps debates on track, and summarizes conclusions clearly.

Another key role of the chairman is ensuring that the board’s work aligns with the company’s strategic goals. This includes scheduling enough time for major topics, encouraging strategic thinking, and ensuring that the board’s collective expertise is applied effectively.

Time Commitment for Non-Executive Directors

Serving as a non-executive director requires a significant commitment of time and effort. The role extends far beyond attending meetings. Preparation, reading board materials, conducting research, and engaging in follow-up discussions are all integral parts of the position.

Before each meeting, non-executive directors often spend several hours reviewing lengthy board packs, financial statements, and reports. They also consult with management, auditors, or stakeholders to gain deeper insights into company performance.

Travel can further increase time demands, especially if meetings are held in different locations or if site visits are required. These visits allow directors to gain first-hand knowledge of operations and better understand the company’s culture and challenges.

On average, non-executive directors dedicate between ten and forty days a year to their role, depending on the company’s size and complexity. The time investment includes attending meetings, reading materials, participating in committee discussions, and engaging in professional development.

Continuous learning is an essential part of being an effective director. Staying updated on governance practices, market trends, and regulatory changes ensures that non-executive directors remain relevant and effective in their oversight duties.

Balancing Governance and Oversight Responsibilities

Non-executive directors must strike a careful balance between oversight and involvement. While they do not manage daily operations, they are expected to question and evaluate management decisions critically.

Their responsibilities include monitoring company performance, ensuring compliance, managing risks, and safeguarding shareholder interests. However, they must also support the executive team by offering guidance and constructive challenge rather than direct intervention.

This balance helps maintain independence while ensuring alignment between management actions and board objectives.

The Role of Committees in Board Governance

Many boards use committees to manage specific aspects of governance. These include:

Audit Committee: Oversees financial reporting, internal controls, and compliance.

Remuneration Committee: Determines executive pay structures and performance incentives.

Nomination and Governance Committee: Manages director appointments, board evaluations, and succession planning.

Non-executive directors often chair or serve on these committees, ensuring independence and impartiality in decision-making. Committee work typically requires additional time outside main board meetings but is essential for thorough governance oversight.

Appointment and Selection of Non-Executive Directors

Non-executive directors are usually appointed through a formal recruitment process based on experience, expertise, and cultural fit. Shareholders and nomination committees may participate in the selection to ensure that appointments reflect company needs.

Diversity of thought and background is increasingly recognized as vital for effective boards. Bringing together directors with varied industry experience, gender representation, and cultural perspectives enhances decision-making and board performance.

Responsibilities and Liabilities

Non-executive directors have legal responsibilities similar to those of executive directors. They must act in the best interests of the company and its stakeholders, exercise reasonable care, and avoid conflicts of interest.

Even though NEDs are not involved in daily management, they can still be held liable if they fail to perform their duties diligently. Maintaining awareness of company affairs, asking probing questions, and ensuring proper documentation of decisions are crucial for risk mitigation.

Impact of Non-Executive Directors on Company Success

Non-executive directors play a vital role in ensuring organizational success. Their independent perspectives encourage transparency, accountability, and long-term thinking. By providing constructive challenges to management, they help prevent groupthink and ensure that major decisions are made responsibly.

They also contribute to reputation management, investor confidence, and corporate sustainability by ensuring that companies adhere to ethical practices and maintain financial integrity. In times of crisis, non-executive directors bring calm judgment and experience, helping companies navigate uncertainty effectively.

Conclusion

Understanding how often do board of directors meet sheds light on how corporate governance functions behind the scenes. Regular, well-structured meetings allow non-executive directors to fulfill their core duties—overseeing strategy, managing risk, and ensuring accountability.

However, the true measure of success lies not in the number of meetings but in the quality of discussions, the strength of relationships among directors, and the commitment to continuous improvement.

Non-executive directors play an indispensable role in shaping a company’s future, providing oversight that balances independence with collaboration. When meetings are purposeful, strategic, and informed, they become a cornerstone of good governance and long-term corporate success.

FAQs

How often do board of directors meet?

Board meetings are typically held several times a year—monthly, bi-monthly, or quarterly—depending on the organization’s needs and structure.

What is discussed in non-executive director meetings?

Topics usually include company strategy, risk management, financial performance, and governance compliance.

How much time do non-executive directors dedicate to their role?

On average, between ten and forty days annually, including preparation, travel, and committee work.

Do non-executive directors have legal responsibilities?

Yes. They must act in the company’s best interests, maintain due diligence, and comply with regulatory obligations.

Why are strategy discussions important for non-executive directors?

They ensure that directors influence the company’s long-term direction and adapt to changing business conditions.

I’m Debabrata Behera, a passionate blogger sharing insights, tips, and stories across diverse topics. Through my writing, I aim to inspire, inform, and connect with readers worldwide.