In the United States, tax forms play a major role in how income is reported and how taxes are paid. Two of the most commonly discussed forms are the W2 and the W9. These forms are often confused, especially by freelancers, first-time employees, startups, and small business owners. While both are related to income and taxes, they serve very different purposes.

Understanding the difference between a W2 and a W9 is important because it affects how taxes are withheld, who is responsible for paying those taxes, and what legal relationship exists between a worker and a business. Using the wrong form or misunderstanding its purpose can lead to tax issues, penalties, or misclassification problems. This guide clearly explains the difference between W2 and W9, who should use each one, and why it matters.

What Is a W2 Form?

A W2 form is a tax document used to report wages paid to an employee and the taxes that were withheld from their paycheck during the year. It reflects a traditional employer–employee relationship where the employer is responsible for withholding and submitting certain taxes on behalf of the employee.

- A W2 is issued by an employer to an employee

- It is given to employees at the end of the tax year

- It summarizes total earnings and taxes already paid

- It is required for employees to file their personal income tax returns

What Is a W9 Form?

A W9 form is used to collect tax information from individuals or businesses that are not employees. It does not report income or taxes paid. Instead, it provides identifying information so that the payer can correctly report payments made to a contractor or vendor.

- A W9 is filled out by an individual or business

- It is requested by the company making the payment

- It provides legal name and tax identification details

- It helps the payer prepare tax reporting forms

W2 vs W9: Key Differences at a Glance

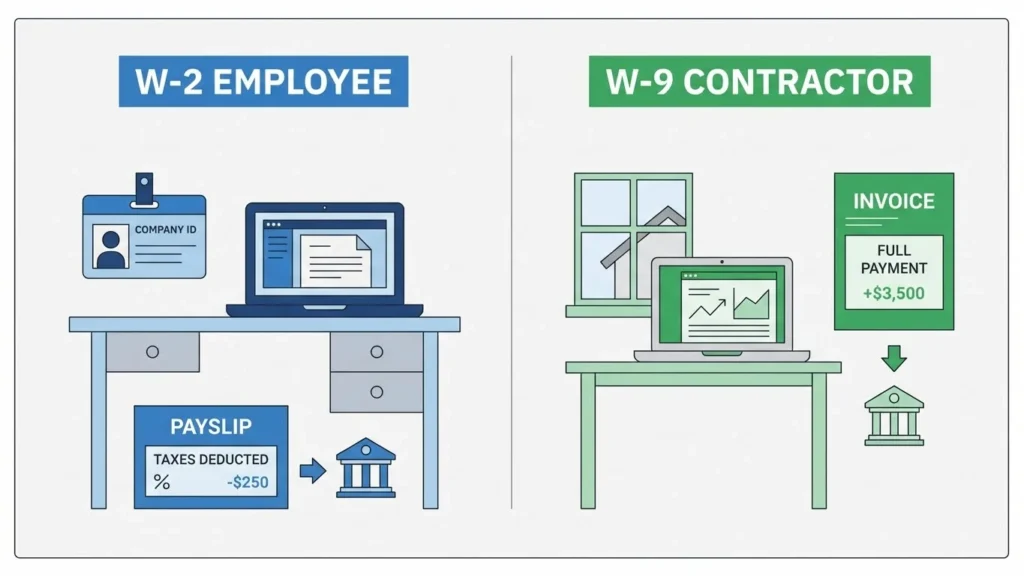

This section highlights the core differences between W2 and W9 forms. The main distinction lies in the type of working relationship and tax responsibility.

- W2 applies to employees, while W9 applies to independent contractors

- Employers withhold taxes for W2 workers, but not for W9 workers

- W2 workers may receive benefits; W9 workers do not

- W2 income is reported directly to the employee, while W9 data supports income reporting through other forms

Detailed Comparison: W2 vs W9

Employment Relationship

The employment relationship is the foundation of the difference between W2 and W9 forms.

- W2 workers are employees under the control of the employer

- Employers set work hours, responsibilities, and processes

- W9 workers are independent contractors or vendors

- Contractors control how and when they complete the work

Tax Responsibilities

Tax responsibility is one of the most important differences between W2 and W9.

- Employers withhold federal and state taxes for W2 employees

- Social Security and Medicare taxes are partially paid by the employer

- W9 workers receive full payment without tax withholding

- Contractors are responsible for paying their own income and self-employment taxes

Benefits and Protections

Benefits and legal protections differ greatly between W2 and W9 workers.

- W2 employees may receive health insurance, paid leave, and retirement benefits

- Employees are often covered by labor protections and employment laws

- W9 contractors do not receive benefits from the payer

- Contractors manage their own insurance, time off, and retirement planning

Income Reporting

Income reporting methods vary depending on whether a worker is W2 or W9.

- W2 forms summarize total annual wages and taxes withheld

- Employees use W2 data to file their tax returns

- W9 forms themselves do not report income

- W9 information is used to prepare income reporting documents for contractors

When Should You Use a W2 Form?

A W2 form should be used when a worker is legally classified as an employee. This classification is based on how much control the business has over the worker and the nature of the job.

- The worker follows a fixed schedule set by the employer

- The employer controls how the work is performed

- The role is ongoing rather than project-based

- The worker is integrated into daily business operations

When Should You Use a W9 Form?

A W9 form is used when paying an independent contractor, freelancer, or vendor. These individuals are not employees and operate independently.

- The work is project-based or contractual

- The worker uses their own tools and methods

- The worker may serve multiple clients

- The business does not control how the work is completed

W2 vs W9 for Businesses

Choosing between W2 and W9 has financial and legal implications for businesses. Proper classification helps ensure compliance and reduces risk.

- W2 workers increase payroll tax and benefit costs

- Employers must manage tax withholding and reporting

- W9 workers reduce payroll responsibilities

- Incorrect classification can result in penalties and audits

W2 vs W9 for Individuals

From an individual’s perspective, W2 and W9 statuses affect income stability, taxes, and long-term planning.

- W2 workers receive predictable pay and tax withholding

- Taxes are simpler because much is handled by the employer

- W9 workers often earn higher gross income

- Contractors must plan for taxes and manage irregular income

Common Mistakes to Avoid

Mistakes related to W2 and W9 forms are common and can be costly. Understanding these errors helps prevent compliance issues.

- Misclassifying employees as contractors

- Assuming W9 income is tax-free

- Submitting incomplete or incorrect information

- Missing deadlines for tax-related paperwork

Conclusion

W2 and W9 forms serve different purposes and apply to different types of working relationships. A W2 is used for employees, where the employer handles tax withholding and reporting. A W9 is used for independent contractors, where the worker is responsible for managing and paying their own taxes.

Understanding the difference between W2 and W9 is essential for both businesses and individuals. Correct usage ensures tax compliance, avoids penalties, and supports clear financial planning. Whether you are hiring workers or earning income, knowing which form applies to your situation helps you stay legally and financially secure.